So What Are Some Of The Effects Of A Good Or Bad Financial Decision?

Many of us believe that we have less funds to upgrade than we actually do.

But arguably, you only need the bare minimum, and a sound calculation by a skilled property consultant can help you to achieve your goals of living and retiring comfortably!

However, a bad property decision could ultimately delay your retirement and prevent you from expanding your space in the future!

Below are 2 case studies presenting the effect of a good or bad property decision:

Case Study #1 (Negative Sale of $71,000)

I had a client by the name of Mr and Mrs Ho, who had purchased an Executive Maisonette around 11 years ago, both were 45 years old at that time.

They had brought an Executive Maisonette for $650k, sized at 147sqm in Serangoon North to have a larger space to accommodate their growing family.

They had used up all of their available CPF funds for the purchase of the Executive Maisonette (Total amounting to $300k) along with their initial deposit to reduce their loan.

They had also taken a HDB Loan of $350k for 20 years with the monthly instalment at $1850/month.

Today (at 55 years old) when they want to sell their property at $780k to cash-out and downgrade to a smaller house for their retirement, they realised they couldn't get back any cash for their retirement even though they had purchased it at $650k previously.

Why?

Because:

Their outstanding loan is $210,000.

The CPF Principle they had used was $522.000.

And the interest payable to CPF was $119.152.

In order for them to breakeven they would need to sell at $851,152, even whey they sell at higher price in today's market value of $780,000.

They still fall into a negative sale of $71,000.

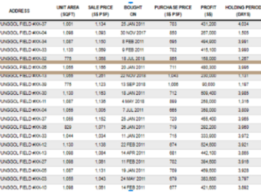

Case Study #2 (Profit of $480,000)

Many 11 Years ago around the same time Mr and Mrs Ho had brought an Executive Maisonette for $650k.

I had another client who had purchased a 3 Bedroom unit in a Private EC (1165 sqft) for $750,105.

On Dec 2021, they sold their 3 bedroom unit for $1,229,075!

They had profited $480,300 in cash and had gotten back close to $500,000 in their CPF.

Today they have managed to down-size to a smaller 3 Room HDB Flat (Fully paid for) and still have more than $500,000 to add to their retirement funds!